GET IN TOUCH WITH NFP SPECIALISTS

Just type your contacts

We we'll get back to you ASAP.

Request a demo

Just type your contacts

PRODUCT CAPABILITIES

Within the framework of budgeting, one of the main tasks of enterprise management is being resolved - a comprehensive assessment of the effectiveness of relevant business models.

Key budgeting features are:

Key budgeting features are:

- modeling of prospective financial conditions of enterprise taking into account various economic factors

- limiting the expenses

- assessment of deviations of actual data with planned

- integration links using

- comprehensive analysis of the results achieved.

To increase the feasibility of making management decisions, convenient tools are provided that allow modeling prospective financial conditions of an enterprise taking into account available resources, as well as opportunities to raise additional capital. When building a business model for it, the following criteria are provided:

- adjustable depth of detail to organizations and departments of the enterprise,

- individual adjustment of each of the models using subordinate budgets of an arbitrary level of complexity,

- unlimited number of simultaneously used models,

- quick and painless replacement of one model with another.

Integration capabilities of budgeting allow to consider data from other sources when building a business model (for example: sales plans, purchases, production).

There is an automatic filling in of an analyst for partners, contractors, contracts, cash flow items from planning documents relating to the company's trade and procurement activities. In addition, payment planning is provided for both of the selected budget item and separate payment planning for the advance payment and payment after shipment.

There is an automatic filling in of an analyst for partners, contractors, contracts, cash flow items from planning documents relating to the company's trade and procurement activities. In addition, payment planning is provided for both of the selected budget item and separate payment planning for the advance payment and payment after shipment.

In order to improve the internal discipline of an enterprise in terms of spending money, it is possible to set individual types of limits for budget items.

The classification by type is as follows:

The classification by type is as follows:

- Allowing - allow holding applications for spending money, if the amount of the application does not exceed the balance on limits (if an excess has occurred, then the application for spending money will be automatically blocked)

- Additionally limiting - perform the function of setting an additional limit to the principal, for example, a limit is determined for the selected cash item, and an additional limit is required on the partner,

- Informational - inform about the exceeding of the limit when carrying out an application for spending money, but do not block its payment.

- Control over the use of funds can be organized for an arbitrary period (day, week, month, quarter, semester, year) for any analysts available for the document Application for spending money (for example, cash flow items, partners, divisions, etc. ).

Comparison of the forecast and actual data of the financial condition of the company is carried out within the business model with the ability to use different scenarios (for example, Quarterly Plan and Quarterly Plan taking into account external factors) with an assessment of the total amounts in currencies:

To simplify the comparison procedure, a script is preset. Actual data, the sources of which can be used:

- operations,

- script,

- management / regulated accounting.

To simplify the comparison procedure, a script is preset. Actual data, the sources of which can be used:

- operational accounting - data sources are business transactions with the ability to determine the source of the amount for the selected operation,

- regulated / international accounting - data sources are balances and turnovers on the accounts of the corresponding chart of accounts,

- arbitrary data - allows you to configure an arbitrary scheme for obtaining any actual data available in the accounting system.

Analysis of the business model allows for a comprehensive assessment of the balance of execution of the subordinate system of budgets in terms of matching the expenses and incomes. A detailed analysis can be made using three different types of budget reports:

Analysis of the achieved results is carried out in the following report groups:

- Budget - displays only planned values,

- Comparison of scenarios - allows to compare different plans and monitor deviations for budget items,

- Plan-actual analysis - allows to compare the selected script with the actual data obtained during the reporting period.

Analysis of the achieved results is carried out in the following report groups:

- statements for the analysis of budgeting data and plan-actual analysis,

- verification reports.

To make the process of agreeing on and executing the budget process faster, a separate mechanism is provided, which makes it possible, with the help of the rules established by the user, to tighten control over the timely execution of specific operations by responsible employees.

Flexibility of adjustment is carried out by means of division of operations into groups and the choice of the most optimal variant of their execution Sequentially or in parallel.

For each operation, there is an automatic and manual mode for the formation of budget tasks for responsible employees with the possibility of notification via e-mail. Moreover, based on the original task, it is possible to create related tasks. In this case, the execution of the main task will be available after all related tasks have been completed.

Flexibility of adjustment is carried out by means of division of operations into groups and the choice of the most optimal variant of their execution Sequentially or in parallel.

For each operation, there is an automatic and manual mode for the formation of budget tasks for responsible employees with the possibility of notification via e-mail. Moreover, based on the original task, it is possible to create related tasks. In this case, the execution of the main task will be available after all related tasks have been completed.

To simplify the monitoring of the timely implementation of the budget process, a separate workplace is provided - the Budget Process Monitor.

The key advantage of the workplace is a compact presentation of large amounts of data, which facilitates management decisions based on visual assessment:

The key advantage of the workplace is a compact presentation of large amounts of data, which facilitates management decisions based on visual assessment:

- planned and actual time spent on budget tasks;

- the estimated time of the end of the budget process.

2 800

enterprises use 1C:ERP

885 000

workstations were automated with 1C:ERP

14

million people - the number of employees that use 1C:ERP

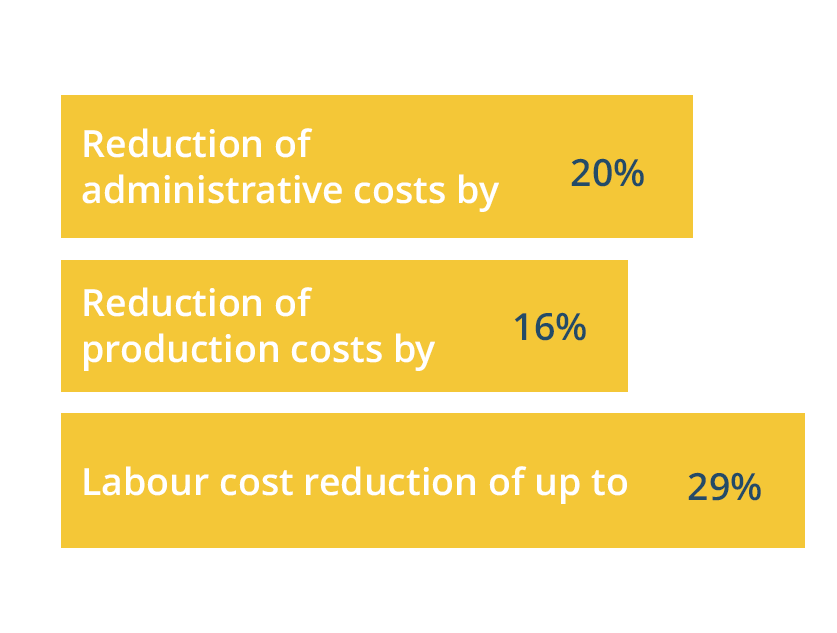

REASONS TO IMPLEMENT 1C:ERP

- 1Optimize the production process, make reliable schedules of activities, taking into account the loading of equipment and the provision of resources

- 2Compatibility with obsolete disparate management systems in order to organize effective work in a single information space;

- 3- It is easy and convenient to track key performance indicators of the enterprise at all management levels;

The coordinated work of the enterprise services in the creating and execution of sales plans, production, procurement; - 4Introduce an effective cash management system, set up optimal ways to achieve the company's financial goals;

- 5Increase the efficiency of commercial and logistics services, improve the quality of customer service, improve the accuracy and timeliness of obtaining information;

- 6Get reliable data of the activities of your company, cost and revenue in the context of the required analyst;

- 7VAT calculation becomes much easier and understandable, 1C: ERP gives a possibility to set up flexible options for an any tax system.

Do you have any questions?

Just leave us your contacts and we'll call you ASAP!

We won't share your contact information with any 3rd parties.